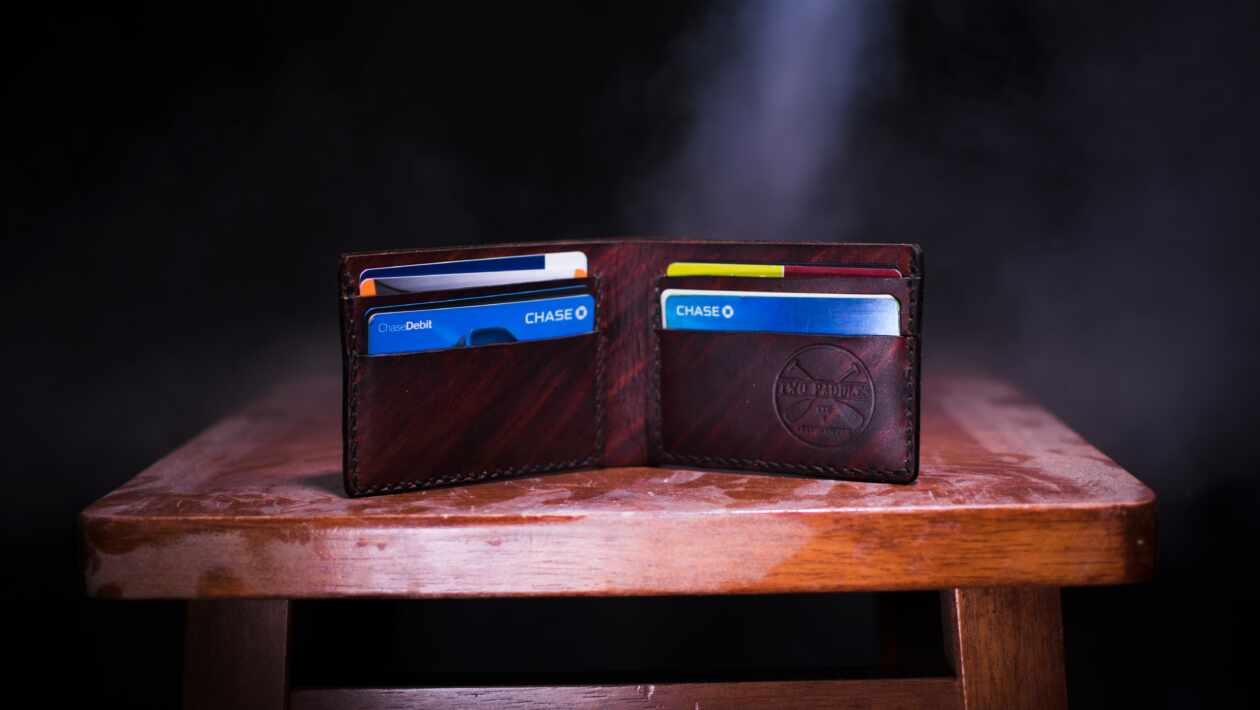

Payment processing is a huge world, that witnesses growth every passing hour. As the payment avenues and technologies expand, the customers now no longer are confined to credit and cash. From using mobile pay apps to debit cards, the customers can define their preference for purchase not just by the products you sell, but also the payment type you accept. This is why one must give close preference and importance while choosing online credit card processing for small business, as it can have a great impact on the sale amount and the customers.

Understand the World of Credit Card Processor

There is no direct interaction for the credit and debit cards for businesses of any kind and size. Third-party credit card processing services are hired with the aid of merchant account providers. They are also called aggregators. To handle transactions, the merchant account providers or aggregators must work with the payment processors.

The process of the credit card can be a confusing task, mainly for the newcomers who take online payments. If you are new to the field, then the below explanations will help you understand your field better. Take a look below.

Merchant Account Providers

They offer your business secured online payment services and POS equipment. The merchant account providers take the information of the payment which is then sent to the payment processor.

Payment Processor

They act as the gatekeeper between the issuing bank or credit card association and the merchant account providers. The information of order payment is sent for authorization and settlement process.

Payment Gateway

It is the application service provider for eCommerce transactions. It permits secure and safe interaction between the payment processor and the merchant account provider. With the help of a payment gateway, the information of the order payment can be sent to the payment processor. It then permits the payment processor to send information to the bank for approval or denial.

This process is allowed for all the card types like credit card gifts cards, debit cards, EBT, etc. The payment processor after receiving the confirmation from the bank, the amount is then transferred through the payment gateway to the merchant account provider. It is then transferred to the business accounts.

Factors to Consider While Choosing Credit Card Processor

If you are looking for the best credit card processing company, then you will have to look for the following factors. You will have to compare the fees, services, and other related things so that you get a clear picture of the offers and services that each company provides.

The most prime factors that need to be considered before selecting them are,

- How much money is lost during the fee payment?

A business owner will face typical fees encounter like

- Application fee – This fee must be paid so that the application is processed

- Setup Fee – It is charged for setting up the equipment

- Monthly Statement Fee – It is the charges for the processor to mail the statement

- Monthly Gateway Access Fee – The data transactions can be charged between the payment processor and the issuing bank

- Interchange Fee – It is charged for every transaction process that your business performs

- Monthly Minimum Fee – A minimal amount of fees is collected from your business when the season of sale is low

- How good is the Processor’s proprietary software?

Since many of the processors work with universal software, you must make sure your eCommerce shopping cart works well with the software. Look out for the processor that provides more options for the payments.

- Do they offer interchange-plus pricing?

It is the transparency that the credit card companies charge. It gives an insightful look into how much the payment processor is paid. This pricing policy helps to keep the expense in check so that you are not charged more.

- What are the charges for early contract termination?

It depends upon varied companies, as each has its policies and contracts. The amount can vary from hundred dollars to thousand of dollars.

The above are a few of the steps that will help you understand the credit card processor. If you are looking for a reliable service provider, then Merchant Services Broker Solutions is the best-recommended one. Call 888-912-6727 for more details!